Coronavirus | COVID-19 Tax Information

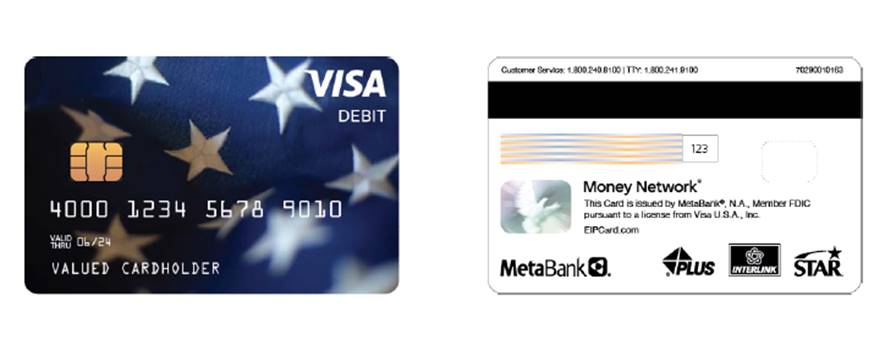

WASHINGTON— This week, Treasury and the IRS are starting to send nearly 4 million Economic Impact Payments (EIPs) by prepaid debit card, instead of by paper check. EIP Card recipients can make purchases, get cash from in-network ATMs, and transfer funds to their personal bank account without incurring any fees. They can also check their card balance online, by mobile app, or by phone without incurring fees. The EIP Card can be used online, at ATMs, or at any retail location where Visa is accepted. This free, prepaid card also provides consumer protections available to traditional bank account owners, including protections against fraud, loss, and other errors.

Client Newsletter – Retirement Plans

NEWSFLASH

NEWSFLASH 4/20/20

Economic Impact Payments

NEWSFLASH

The federal EIDL loans through the SBA with the component of the $10,000 advance that would be turned in to a grant has been modified. Now there is a limit of $15,000 that can be applied for overall for loans related to Covid-19 relief and the emergency advance is now limited to $1,000 per employee. Backpedaling on the part of the SBA, most likely due to the overwhelming amount of small business owners applying for emergency relief.

Rules and regulations regarding the EIDL and PPPL loans are evolving daily and, obviously, subject to change.

2020 CARES ACT (PDF)

Friday, March 27th, 2020

CARES ACT – STIMULUS CHECKS

The Senate unanimously passed the Coronavirus Aid, Relief and Economic Security Act (CARES), the House is expected to pass it Friday morning, March 27th, and the President is expected to sign it into law shortly after.

“Stimulus Checks” – US Residents with Adjusted Gross Income up to $75,000 ($150,000 married) who have a work eligible social security number are eligible for the full $1,200 ($2,400 married) rebate. An additional rebate amount of $500 per child applies. It is expected these rebates will be issued based on 2019 tax returns or 2018 if 2019 has not been filed.

No action on the taxpayer’s part is expected to be needed, however, those who do not normally file tax returns because they have no filing requirement may want to file in order to receive the benefit.

Taxpayers with incomes above the amounts previously mentioned will receive reduced amounts and the rebate will be completely phased out for single taxpayers with incomes higher than $99,000, Head of Household filers with incomes higher than $146,500 with 1 child, and $198,000 for joint filers with no children.

This legislation is not yet final and no guidance has been issued so please understand this is general information meant to communicate current developments only. Come back here for additional information as it becomes available.

Questions about Economic Impact Payments

The IRS is issuing Economic Impact Payments. These payments are being issued automatically for most individuals. However, some people who don’t usually file a tax return will need to submit basic information to the IRS to receive their payment.

Questions? The IRS is regularly updating the Economic Impact Payment and the Get My Payment tool frequently asked questions pages on IRS.gov as more information becomes available. Here are answers to some of the most common questions.

How are payments calculated and where will they be sent?

If taxpayers have already filed their 2019 tax return and requested direct deposit of their refund, the IRS will use this information to calculate and send their payment. Those who didn’t provide 2019 direct deposit information or owed tax, can use the Get My Payment tool to provide account information or a payment will be mailed. For those who haven’t filed their 2019 return, the IRS will use their 2018 tax return to calculate the payment.

Payments will also be automatic for those who receive Social Security, railroad retirement or Social Security Disability Insurance (SSDI and SSI) and veteran’s benefits who don’t normally file a tax return.

However, to add the $500 per eligible child amount to these payments, the IRS needs the dependent information before the payments are issued. Otherwise, their payment at this time will be $1,200 and, by law, the additional $500 per eligible child amount would be paid in association with a return filing for tax year 2020.

What if the IRS doesn’t have the taxpayer’s direct deposit information?

If the IRS has not processed the taxpayer’s payment, the taxpayer may be able to use the Get My Payment tool to provide their banking information to the agency so their payments can be directly deposited. If no banking information is provided, IRS will mail a check to the taxpayer’s address on record. The direct debit account information used to make payments to the IRS cannot be used as the account information for the direct deposit of your payment.

Can taxpayers who aren’t required to file a tax return receive a payment?

Yes. People who don’t normally file can use Non-Filers: Enter Payment Info tool to give IRS basic information to get their Economic Impact Payments. This includes low-income or no income taxpayers.

Can taxpayers who haven’t filed a tax return for 2018 or 2019 still receive a payment?

Yes. Anyone who is required to file a tax return and has not filed a tax return for 2018 or 2019 should file their 2019 return do so as soon as possible to receive a payment. They should include direct deposit banking information on their return.

I received an additional $500 in 2020 for my qualifying child. However, he just turned 17. Will I have to pay back the $500 next year when I file my 2020 tax return?

No, there is no provision in the law requiring repayment of an Economic Impact Payment. When you file next year, you can claim additional credits on your 2020 tax return if you are able to eligible for them, for example if your child is born in 2020. But you won’t be required to repay any Payment when filing your 2020 tax return even if your qualifying child turns 17 in 2020 or your adjusted gross income increases in 2020 above the thresholds listed above.